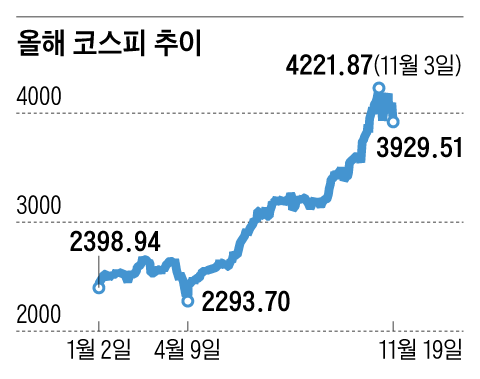

This year, the KOSPI exceeded the 4,200 level for the first time, signaling an extraordinary upward movement. Nevertheless, retail investors...

This year, the KOSPI exceeded the 4,200 level for the first time, signaling an extraordinary upward movement. Nevertheless, retail investors who joined the stock market later are now experiencing increasing worries. Although individual investors kept selling more than buying as the KOSPI climbed from 2,600 to 4,000, they only started net buying this month after the index crossed 4,000 and hopes for a "KOSPI 5,000 era" intensified. At the same time, credit financing—money borrowed from securities companies to buy stocks—has reached a record high, increasing the debt load for individual "debt investors" (빚투). However, shortly after the KOSPI surpassed 4,200, worries about a U.S.-driven artificial intelligence (AI) "bubble" and policy uncertainties caused the index to drop back to the 3,900 level, putting late entrants in a tough situation.

◇ Latecomer Retail Investors Join the "KOSPI 5,000" Surge

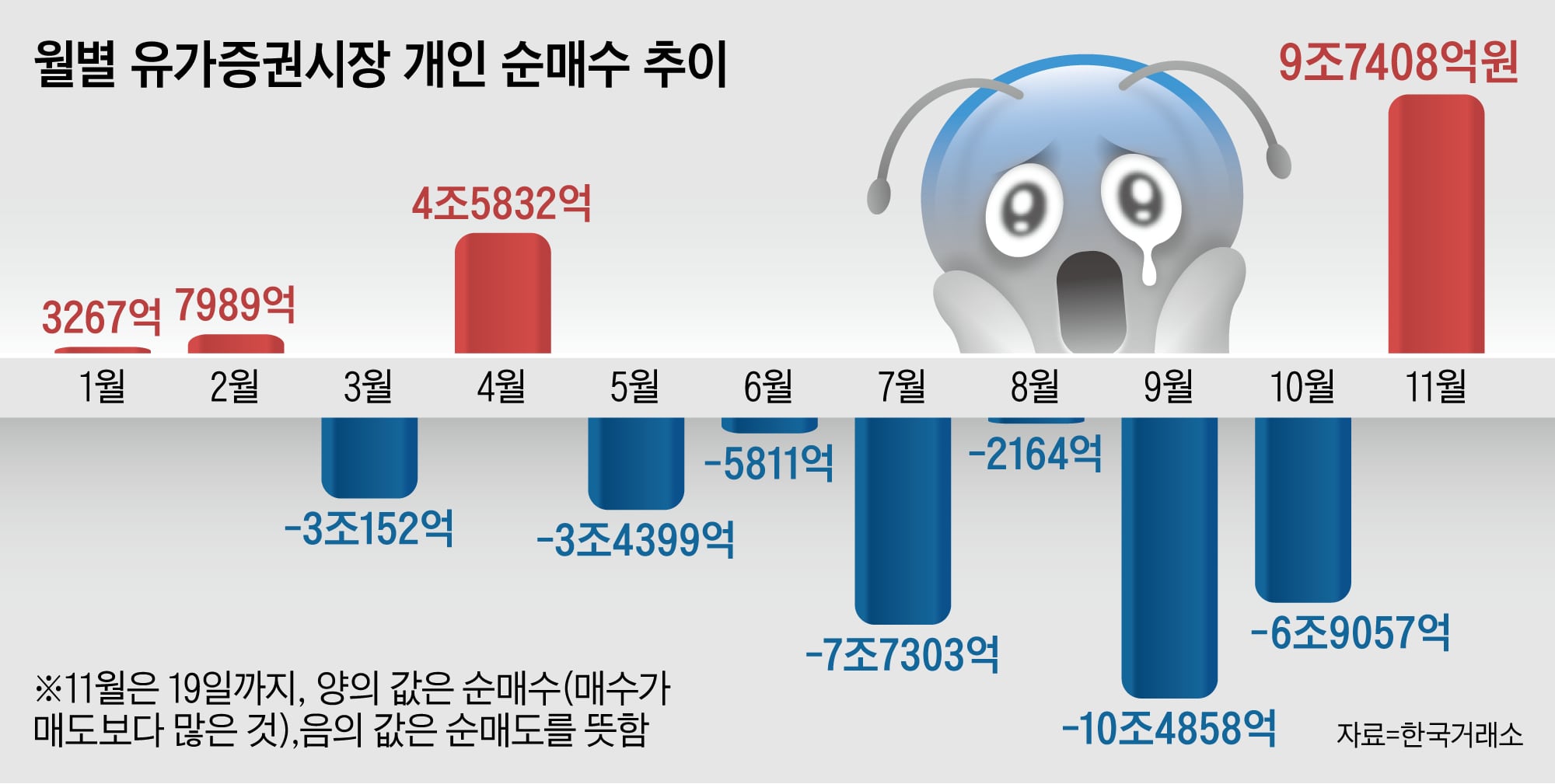

Individual investors have consistently engaged in net selling every month from June to October this year, during the period when the KOSPI started its significant upward movement. Even in September and October, as the index climbed from 3,100 to 4,000, they sold a total of 10.4858 trillion Korean won and 6.9057 trillion Korean won worth of stocks, respectively. However, this month saw a change in direction. With the KOSPI surpassing 4,200 on the 3rd, sparking expectations of reaching "KOSPI 5,000," individual investors net purchased 9.7408 trillion Korean won worth of stocks by the 19th.

This change is viewed as indicating significant political initiatives aimed at enhancing the stock market. President Lee Jae-myung introduced "KOSPI 5,000" as a national goal, while the Democratic Party of Korea established a "KOSPI 5,000 Special Committee" to quickly advance shareholder-oriented laws, such as revisions to the Commercial Act. In July, the party broadened directors' fiduciary responsibilities to encompass shareholders, and in August, it required cumulative voting that benefits minority shareholders. Recently, there have also been talks about lowering the top tax rate on dividend income and requiring stock repurchases.

Nevertheless, as people started to enter the market more seriously, concerns about a U.S.-led AI bubble arose, making things more complex. The KOSPI experienced significant fluctuations after exceeding 4,200 and dropped to the 3,920 level by the 19th.

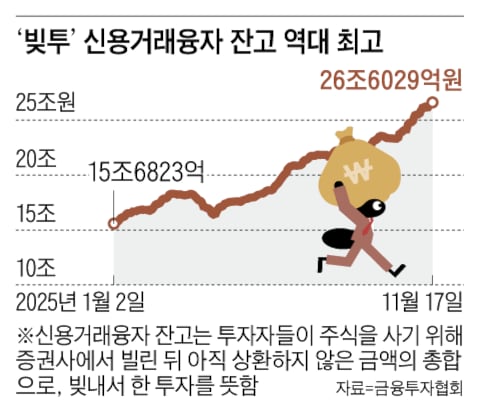

◇ Record High "Debt Investment"… Increasing Dangers of Mandatory Liquidation

As stock prices varied, the pressure on individuals who took loans to purchase stocks at the peak has increased. Credit financing, which was 15 trillion South Korean won at the beginning of the year, rose to 26 trillion South Korean won this month. Experts say this is due to new participants entering the "debt investing" trend during the "KOSPI 5,000" excitement.

As a result, the likelihood of forced selling—where securities companies sell pledged stocks if their value falls below a certain level—has gone up. According to data obtained by People Power Party Representative Yoon Han-hong from the Korea Financial Investment Association, forced liquidations amounted to 59.4 billion South Korean won in June, rising to 81.3 billion and 91.9 billion won in July and August, respectively, during a period of market consolidation. These figures dropped to 83.8 billion and 64.7 billion won in September and October as the market experienced a strong rebound but increased again to 52.3 billion won by the 12th of this month as the index fluctuated. Amid these developments, controversy emerged from comments made by a senior financial official. Financial Services Commission Vice Chairman Kwon Dae-young recently mentioned on a radio interview that "debt investing is a form of leverage," leading to criticism that the government was downplaying the risks associated with individual investors' high-risk bets. Kwon later explained that his message had not been clearly conveyed.

Rep. Yoon stated, "Although the government and the ruling party highlight the 'KOSPI tailwind,' many individual investors are facing forced sales and potential losses. Rather than artificially boosting the market and promoting debt-based investments, they should concentrate on establishing a robust market grounded in company performance."