Gwangjang Market represents the history of Seoul and is a source of pride for South Korea. We will no longer allow the market's reputati...

Gwangjang Market represents the history of Seoul and is a source of pride for South Korea. We will no longer allow the market's reputation to be damaged.

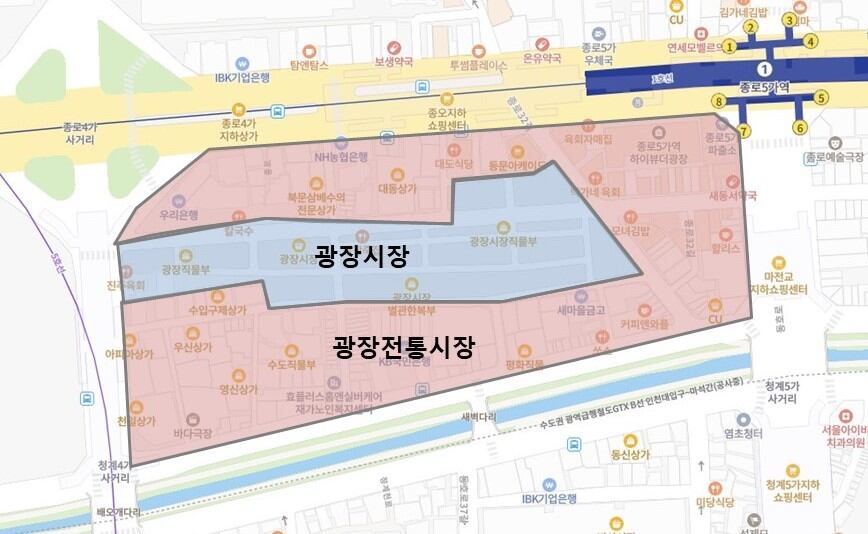

On the 12th, the merchants' association of Gwangjang Market in Jongno-gu, Seoul, sent a certified letter with this message to the neighboring Gwangjang Traditional Market Merchants Association. The next day, they also issued a notice stating, "We will proceed with a lawsuit seeking 300 million Korean won in damages." A legal conflict has arisen among the merchants as Gwangjang Market continues to face criticism over the "overcharging controversy." The merchants have criticized each other, saying, "We sell food at fair prices, but other merchants are charging excessive rates and pressuring sales." A source from the Gwangjang Traditional Market Merchants Association said, "After receiving the certified letter, the association held an internal meeting once, and will prepare countermeasures after another discussion at the end of November." The area commonly known as "Gwangjang Market" is divided into "Gwangjang Traditional Market" and "Gwangjang Market." Gwangjang Market is located in the center of the district, surrounded by Gwangjang Traditional Market.

The event began with a video posted on YouTube on the 4th. A YouTuber, who ordered a sundae from a food stand in Gwangjang Traditional Market, questioned, "Why are you charging 10,000 Korean won when the menu lists it as 8,000 Korean won for a sundae?" The staff responded, "I added meat to the sundae." Nevertheless, the YouTuber argued that the stand unreasonably included meat without their permission, resulting in an excessive charge.

The issue is that vendors at Gwangjang Market, located near Gwangjang Traditional Market, are also experiencing losses because of this video. Vendors at Gwangjang Market have shown frustration, stating that since the video was posted online, public perception has shifted against them, with the market being labeled as "a place where prices are inflated," resulting in a significant drop in sales. A man in his 50s who owns a restaurant in Gwangjang Market mentioned, "Fixed expenses such as monthly rent amount to 20 million Korean won per month, but since the overcharging controversy emerged, sales have fallen to levels seen during the pandemic." He further stated, "I am upset with both the merchants' association for only imposing minor penalties and the local office for not handling the situation effectively." A representative from the Gwangjang Market Merchants Association spoke up, saying, "Last July, a broadcast showed an image of one of our merchants brushing their teeth and spitting water next to a seafood box they were selling, so we immediately shut down the business. Why do the other side only face a 10-day business suspension?"

Indeed, when a reporter from this newspaper visited Gwangjang Traditional Market at approximately 12:30 p.m. on the 19th, the prices were not low, even though it is a traditional market. A tteokbokki set priced at 3,000 Korean won contained only six small rice cakes, shorter than a finger, without additional items like fish cake or egg. Fish cake was sold for 1,500 Korean won per skewer—50% more expensive than the typical 1,000 Korean won found in regular stores. Some vendors offered a single live octopus for 18,000 Korean won, nearly three times pricier than Noryangjin Fish Market, where three octopuses are available for about 20,000 Korean won. A male tourist in his 30s from Singapore remarked, “I bought it thinking of it as an experience, but in Singapore’s traditional markets, noodles cost roughly 4,000 to 5,000 Korean won, whereas most here are around 8,000 Korean won, which felt quite costly.”

This is not the first instance where Gwangjang Traditional Market vendors have been criticized for charging excessive prices. In November 2023, a mixed jeon dish with only 8-9 pieces of adult-sized jeon was sold for 15,000 Korean won, leading to public debate. In April of last year, a customer who ordered six meat dumplings priced at 5,000 Korean won had kimchi dumplings arbitrarily added to their order, resulting in nine dumplings being sold for 10,000 Korean won, which drew backlash. Kim Pil-je, 65, who has been selling dried seafood and ceremonial goods at Gwangjang Market for 20 years, stated, "Every time there's an overcharging issue at traditional market stalls, sales drop significantly. It's disappointing because we put in hard work, pay taxes, and manage our businesses, but the negative image hurts us."

Following the "mixed jeon controversy," the Gwangjang Traditional Market Traders' Association convened a meeting to avoid similar incidents in the future. During this meeting, the association resolved to suspend businesses that overcharge or receive other complaints, provide monthly training for merchants on improving service quality, and introduce a system for clearly indicating the exact amounts of food.

Nevertheless, these actions seem to be mere empty pledges. As per the Gwangjang Traditional Market Merchants Association, service training is held just twice annually. The QR menu board, implemented as a solution to challenges in precisely showing food portions, has been adopted by only 88 of the 114 food vendors in the market. The QR menu system shows images and details of dishes in 20 languages when customers scan the code. Penalties for overcharging usually last about 10 days, which some believe is insufficient. Only 77 of the 114 food stalls have installed card payment machines.

As conditions deteriorated, Jongno-gu began imposing road usage fees on vendors in Gwangjang Traditional Market this month—22 years following the establishment of the merchants' association. Nevertheless, there are concerns that the annual road usage fee, which varies between 200,000 and 3.5 million Korean won depending on the stall's size, is excessively low. Vendors operate illegally since they are unable to acquire permits under the Food Sanitation Act, and the market's reliance on cash transactions facilitates tax evasion, a problem that continues to persist.